What is a homeowners insurance premium?

A homeowners insurance premium is the amount you pay to an insurer to cover the cost of repairing or replacing your home following a covered loss. It can either be paid quarterly or annually.

What is the cost of home insurance?

In the event that your home is damaged, the premiums you pay will cover the costs to repair or replace the building and its contents. Also known as a home insurance policy, or dwelling coverage policy.

Reduce your claim risk to lower the cost of your homeowners insurance. This includes reducing your coverage and adding safety measures to your house such as fire and burglar alarms.

What factors determine the cost of your homeowner's insurance?

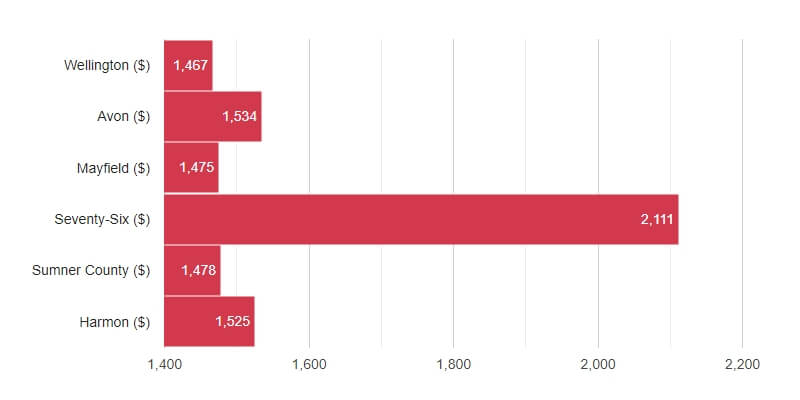

Location is a major factor in determining your homeowners' insurance premium. If you live in a crime-ridden area or one that is prone flooding or earthquakes then your homeowners insurance will be more expensive.

Your homeowners insurance rate can be affected by the age and type of structure that you insure, as well as materials used to construct it. For example, if you have an older wood frame home, your insurance rate is more likely to be higher than someone with a modern, energy-efficient home.

The length of time you've been insuring is another factor that could affect your homeowners insurance. If you have been insuring for your home longer than five year, you should expect an increase in premium, even if no claims have been filed.

If you're a new homeowner, you may be eligible for a discount on your home insurance premium. It is based on the age of your home and your credit rating. This can result in a substantial savings.

The presence of a pool or other safety measures around your pool can also increase the cost of your homeowners' insurance. You'll need to install safety measures or a fence around a pool if you own one.

You may also find that the cost of your homeowners' insurance is higher if your house is older and in a poor state. It's because a home that is older and poorly maintained can pose a greater risk to an insurer than a home that is brand new and energy efficient.

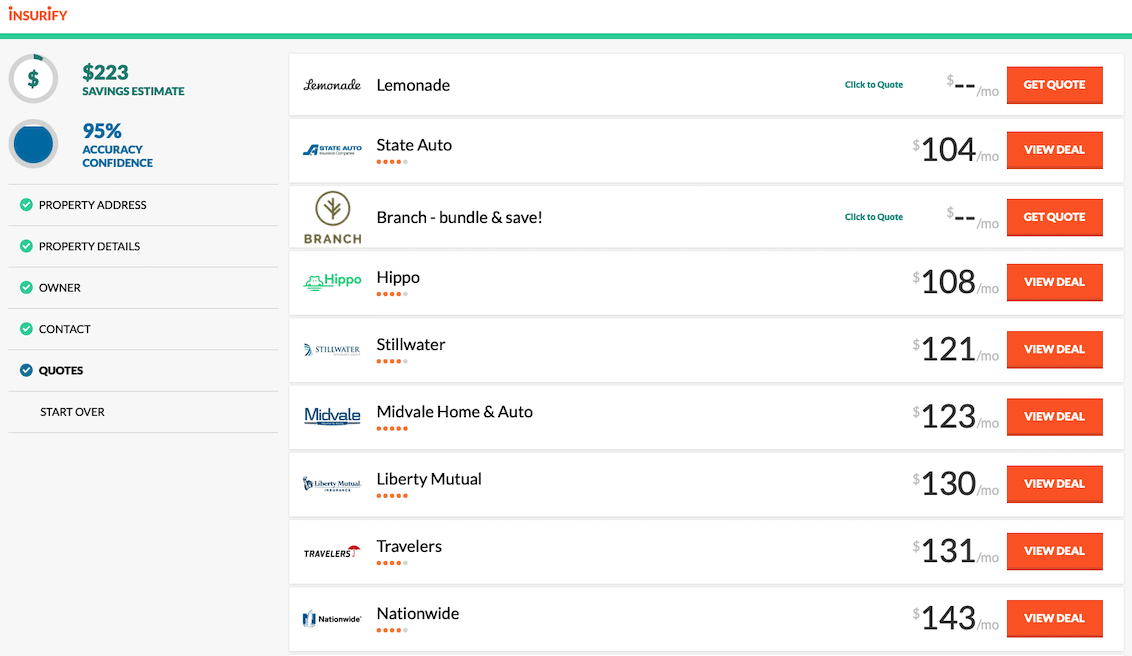

How can homeowners insurance be reduced?

Some of the most popular ways that you can lower your homeowners insurance premium include lowering the amount of coverage you have on your home, increasing your deductible, and making other changes to your policy. These changes will help you to save money without compromising the level of protection you receive.