A new home insurance policy is a good option for homeowners renovating their existing home or building one. This can be a cost-effective way to protect yourself from unplanned damages and losses.

There are several policies that can be used to cover new construction. One is called "new homeowner insurance," and it covers damage to the building itself, as well as belongings within the property. Another is "building home insurance." This covers damage to materials used in the construction of the structure both on and off site. This may include additional structures such as fences or outbuildings on your property.

As soon as you have found the perfect location, it's wise to begin shopping for insurance for your new home. This will let you find the best insurer and save money.

It will cover your property and any belongings such as clothing, furniture, appliances and electronics. It will also provide liability protection to cover medical expenses in case someone is injured on your property, and it will cover any losses resulting from vandalism or theft.

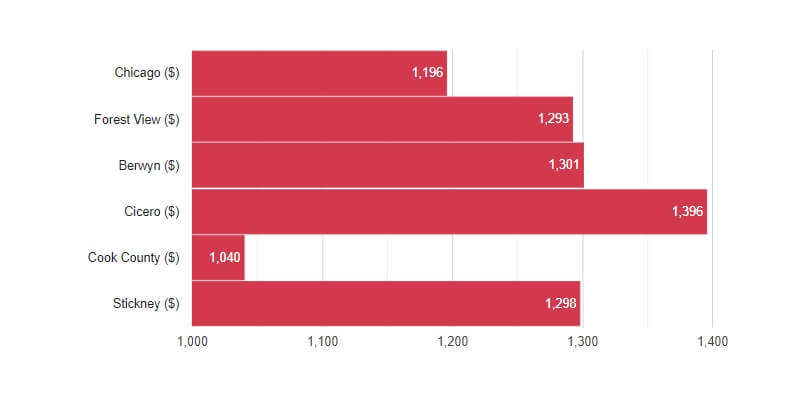

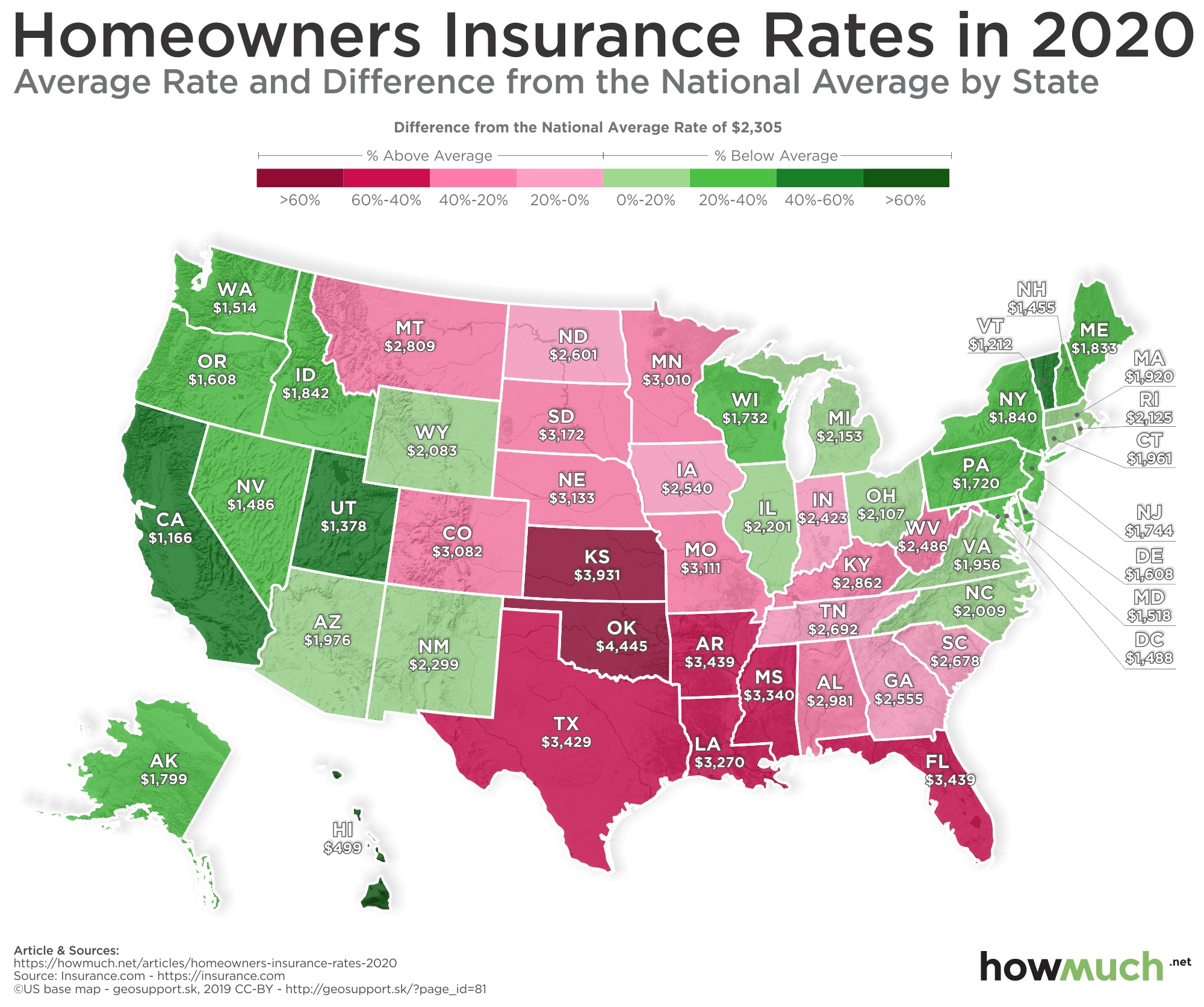

Insurance costs for a new building will vary depending on what type of construction you are planning and the amount you intend to spend. Certain companies will offer discounts for installing certain systems and devices in your home to help prevent break-ins or fires. Other discounts can be obtained by using a roof that is made of stronger, more durable materials.

You can purchase a separate insurance policy to cover weather-related damages or any other damage that may occur during construction. It is also known as "builders' risk insurance." You'll need to purchase it before the construction begins and change it to a standard homeowners insurance policy once the work is completed.

Insuring newly built homes is usually less expensive than insuring older ones because of the lower likelihood that they will suffer significant damage. It is because the newer materials used in building new homes make them less prone for breakdowns or repairs. Therefore, insurance companies are more comfortable with offering lower rates.

Important to note is that a homeowners' insurance policy for newly built homes will only include the main home and other structures, but not any contents coverage, liability coverage, or even loss of use. However, some policies do have an add-on that will allow you to insure all your personal belongings and other items within the home under the same policy.

Some insurance policies for new construction homes include additional features, such as water-detecting systems that can cut off the water if the plumbing has a leak. You can avoid costly claims as water damage is the leading cause of property damage.